How True Superhero Ben Bernanke Averted A Financial Catastrophe

When Ben Bernanke was announced by the Nobel Committee as one of the joint winners of the 2022 Prize in Economic Sciences, many people assumed it was in recognition of his role as chair of the Federal Reserve during the 2007 global financial crisis. In fact the award was given for the decades he had previously spent researching the 1929 Wall Street Crash, and the decade-long Great Depression that followed it. That award winning research hasn’t just helped to improve economists’ understanding of the causes of market volatility, it also proved invaluable when Bernanke was faced with his own financial crisis, and helped to inform the actions that he took to avert a repeat of the Great Depression.

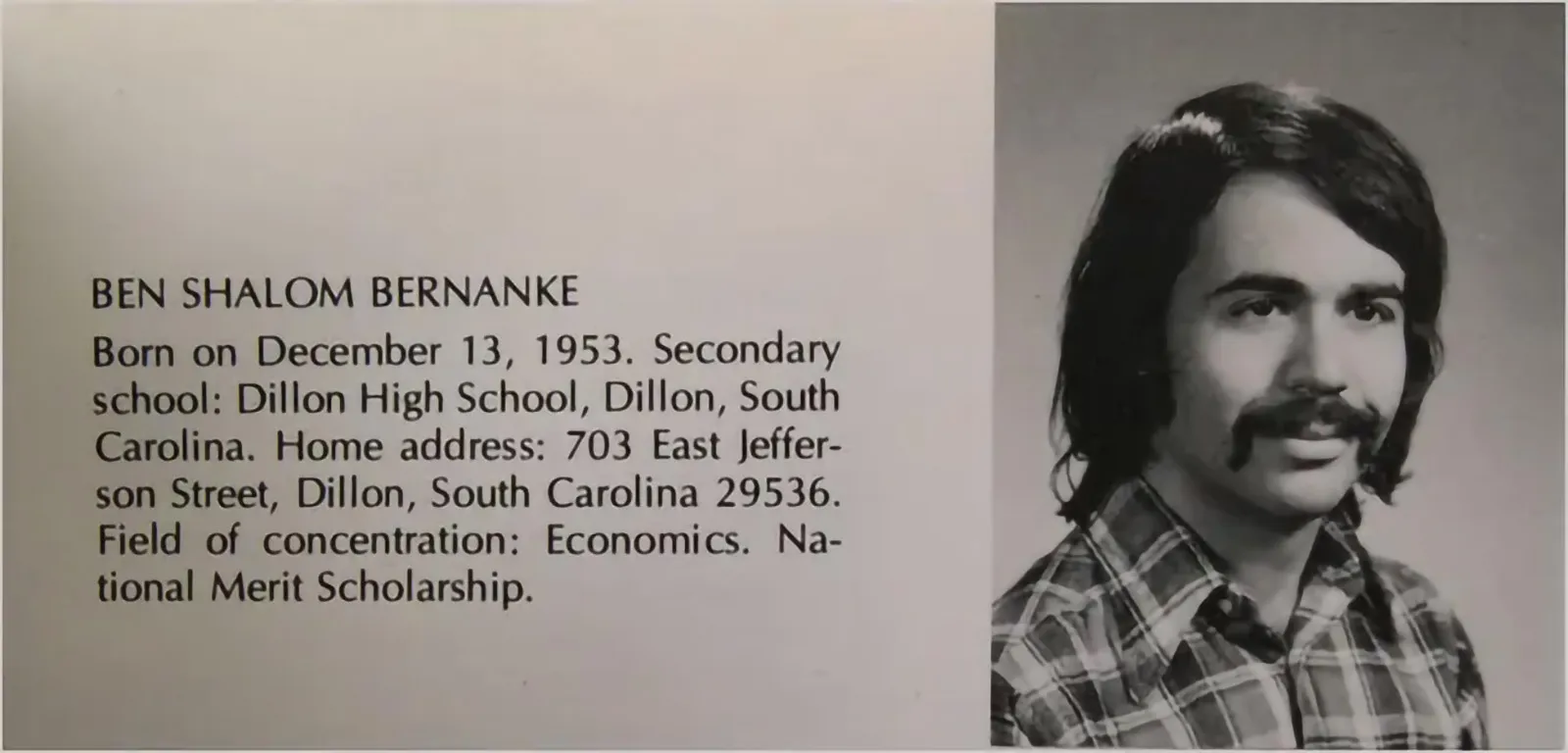

Small town boy

Ben was born in 1953 into a Jewish family living in the small town of Dillon, in South Carolina. When his parents had originally moved to the town his father, Philip, worked as a stage manager in a community theater, but Ben’s arrival meant the family needed more regular income and consequently Philip joined the family business, working at the drugstore that had been set up by Ben’s grandfather. The Bernankes were not well off by the standards of their neighbors, but this was still a time of segregation and Ben grew up keenly aware of the racial, social and financial inequalities that existed in his hometown. As one of the few Jewish families in the small, almost exclusively Christian community of Dillon the Bernankes were more sensitive to racism than most, and the family business served and employed all of the town’s residents without discrimination, despite the segregation laws still in place at the time. This open minded approach to business may well have been a contributing factor in a fortuitous development in young Ben’s life.

"The brand new social experience where you activate your gaming skills as you train like a spy."

- TimeOut

Take on thrilling, high-energy espionage challenges across different game zones.

Ben was an exceptional scholar from an early age, winning state spelling bees and skipping grades. He had a great interest in mathematics and taught himself calculus from books, as the subject wasn’t taught in his high school. This prodigious thirst for learning brought him to the attention of Kenneth Manning, a member of one of Dillon’s most prominent black families whose number included an attorney and a local basketball star. Kenneth - a few years older than Ben - was a graduate student at Harvard at the time, and would go on to become a professor at MIT. He would later say “anybody with any sense could see that Ben was unbelievably bright”, and took it upon himself to persuade the Bernankes that Ben should apply to Harvard. Ben’s family were skeptical, wanting their son to stay within the small, tight-knit community they had built up in Dillon, and reportedly believing that Ben “would lose his Jewish identity” at Harvard. Manning successfully persuaded them that this would not be a problem in Boston, but the negotiations were not always smooth; on one occasion the family was seen eating with Manning at a local restaurant, and they returned home to see their home had been pelted with eggs.

A long way from Dillon

Ben’s parents eventually relented, on the proviso that Ben take on a job to fund his fees at Harvard. Keen to do whatever it took to leave Dillon, Ben took the first job he could find, working as a construction laborer on a nearby building project. Although short and slight, he quickly established himself as a capable worker, and soon acquired the funds needed to launch his academic career. He arrived at Harvard in 1971, and within 20 minutes of arriving on campus he was convinced that he would be arrested. He arrived at his dorm to find a large bag of marijuana on the floor and his roommates blasting Jimi Hendrix through speakers on the open window. The campus police arrived and calmly asked them to turn the music down, with no arrests being made. Although he was - as he later described it in his autobiography - “a long way from Dillon”, and fascinated by the extremely different culture he suddenly found himself immersed in, his faith and Jewish identity were unaffected. Kenneth Manning would drive him to the synagogue in nearby Brookline to attend services, and Ben would later write that “he felt more at home in Cambridge than I ever had in Dillon”.

After much deliberation, he eventually chose to major in economics, and after graduating he studied for a Ph.D. at MIT, before becoming a professor at Stanford University. It was here that he began his research into the causes of the Great Depression of the 1930s, which would eventually lead to him being awarded the Nobel prize for Economics in 2022. This research also led to a great deal of theorizing on the impacts of contemporary monetary policy, and Ben became one of the most prominent experts in the field. In 2002, he took the decision to make the leap from studying monetary policy to shaping it, as he accepted an offer from President George W. Bush to serve on the Federal Reserve Board.

By this stage Bernanke was making optimistic predictions of future stability in global economic markets. He gave a famous speech in 2004 where he referenced the theory of the “Great Moderation”, which suggested that the relative lack of market volatility since the mid 1980s was a sustainable feature, but events would shortly prove this theory spectacularly incorrect. Signs of trouble began appearing on the horizon shortly after Ben’s promotion to chairman of the Federal Reserve in 2006, and as 2007 drew on it was clear that a financial crisis was brewing that was quite unlike anything that had gone before for many decades. In fact, the thing it most resembled was the Great Depression.

Fighting The Great Recession

The second half of 2007 was characterized by the collapse of investor confidence around the globe, and a lack of confidence turned to panic following a run on the UK bank Northern Rock. Television screens carried footage of enormous queues of the bank’s customers desperately trying to withdraw their money, something that had not happened in the UK since the 1860s. Suddenly nobody was talking about warning signs, because the thing everybody feared had come to pass, a global financial collapse that would come to be known as the Great Recession.

It continued to get worse for the following year. In March of 2008 Bernanke authorized a $30bn loan to enable JPMorgan Chase’s rescue of failing Wall Street investment bank Bear Stearns. By early September the Bush administration had been forced to take over Fannie Mae and Freddie Mac, the two companies that financed half of all residential mortgages in the US, but even this intervention could not calm the markets. Barely a week later one of the largest investment banks in the US, Lehman Brothers, filed for bankruptcy, sending the Dow Jones Index - which had already withstood a year long battering - into a 500 point nosedive. It seemed that American Investment Group (AIG), the world’s largest insurance company, would be the next to go under. Fearing the global repercussions of the collapse of an insurer who operated in 130 countries, Bernanke persuaded lawmakers to authorize an $85bn bailout of AIG. He also lobbied for a much larger relief package totalling $700bn to buy up toxic mortgage debts in the economy; telling the Speaker of the House of Representatives, "If we don't do this, we may not have an economy on Monday." After some difficulty the Troubled Asset Relief Package (TARP) was eventually voted through, although in the final analysis only $426bn was invested, and eventually the full sum was recouped, and may even have turned a small profit.

Counting the cost

These measures, along with other drastic actions taken by the Fed such as slashing interest rates to 0% and announcing $1.3tn of quantitative easing in November 2008, have proved controversial with many economic experts. Bernanke has faced criticism for not acting sooner to avert the crisis, and making what some believe are the wrong choices after it had begun, but there is little doubt that the consequences of the Great Recession could have been far worse and pale in comparison with the long term economic damage wrought by its 1930s counterpart. Bernanke’s studies of the Great Depression proved invaluable in his efforts to avert a repeat, and the 2007 financial crisis was much shorter and less damaging. Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009, and the recovery period was also far shorter.

For Bernanke, this can only be seen as a vindication of his actions, and also the decades he spent researching the underlying causes of the Great Depression and the long shadow it cast on the global economy throughout the 1930s. He has acknowledged that many of the measures taken during his tenure as chair of the Fed were tremendous risks that could have exacerbated the crisis, had they backfired, but they did not. As someone who had grown up surrounded by inequality, and has always sought to alleviate it, taking such enormous risks and successfully avoiding the consequences of failure were truly superheroic actions, and the Nobel prize is a fitting reward for a True Superhero who pulled the global economy back from the brink.

SPYSCAPE+

Join now to get True Spies episodes early and ad-free every week, plus subscriber-only Debriefs and Q&As to bring you closer to your favorite spies and stories from the show. You’ll also get our exclusive series The Razumov Files and The Great James Bond Car Robbery!

Gadgets & Gifts

Explore a world of secrets together. Navigate through interactive exhibits and missions to discover your spy roles.

Your Spy Skills

We all have valuable spy skills - your mission is to discover yours. See if you have what it takes to be a secret agent, with our authentic spy skills evaluation* developed by a former Head of Training at British Intelligence. It's FREE so share & compare with friends now!

* Find more information about the scientific methods behind the evaluation here.

Stay Connected

Follow us for the latest

TIKTOK

INSTAGRAM

X

FACEBOOK

YOUTUBE